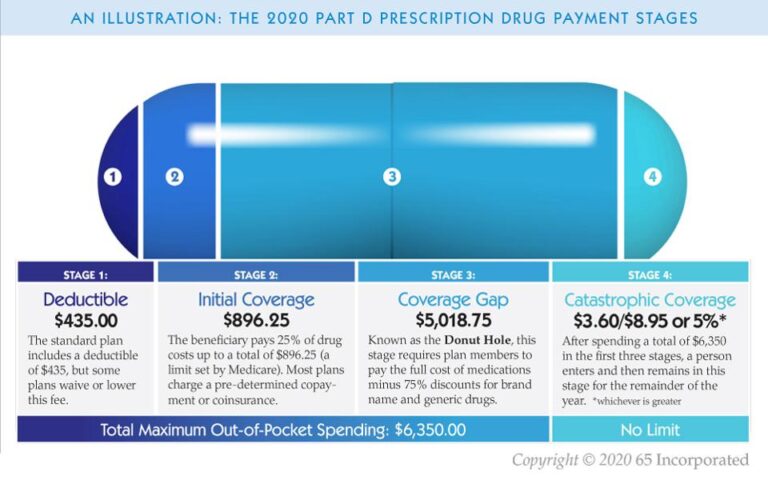

The Medicare Prescription Drug Coverage (Part D) is a voluntary program that officially started on January 1st, 2006 and offers some assistance to U.S. seniors that incur a personal expenses for their prescription medications. Multiple plans are available through private insurers and participants need to carefully select the plan that best suits their individual needs. Although premiums may vary, the average monthly premium for a Medicare Part D prescription drug plan in 2020 is estimated at around $60, higher than in 2019, with a $ 435 deductible and a 25% co-pay on the first $5,018.75 of drugs purchased annually ($3,820 in 2019). Therefore the cost of participation will generally exceed $2067.50 per year with a large gap in coverage between $4,020 and $6,350 (the “donut hole”) where patients must pay for 25% of their Brand medication cost and 25% of their Generic medication cost.

The largest basic plan, SilverScript Choice, will charge an average of $18.90 per month next year. Humana Walmart RX will charge $26.20 per month. Most enhanced plans offer some coverage in the so-called donut hole, but also come with higher premiums. For example, AARP MedicareRX Preferred, which is the largest of the top 10 plans, will see its average premium jump 8 percent next year to $71.70, according to Avalere.

In other words, before the 95% catastrophic coverage can begin a patient would pay $1,689.69 plus a monthly premium, about $2,067.50 out of pocket each year. As such, it is important for U.S. seniors to carefully analyze their specific prescription needs and assess the benefit before enrolling in the program. In some cases, it may be more attractive to order medications from ADV-Care instead. It may also be prudent to enroll in a Medicare Part D plan and order some drugs from us as well. There may be circumstances whereby specific drugs may not be covered under this plan or when coverage is absent (i.e. the donut hole and Canadian drug price is lower than the plan copay) thus making it attractive to order them from Canada where savings average about 50%. Although Canadian purchases will not count toward the patient Medicare account they may be an ideal safety net for the gaps in Medicare coverage. Taking advantage of both programs may be a wise choice.

ADV-Care Pharmacy is pleased to assist our customers with a case analysis of their prescription requirements. As a first step, we will use the Medicare Benefit calculator that will analyze Medicare costs vs. our cost and their relative savings. Just input the amount our customers expect to pay for their medications in U.S. retail dollars.

Photo by Dominik Lange on Unsplash